Business Insurance in and around Lincoln

Get your Lincoln business covered, right here!

Helping insure small businesses since 1935

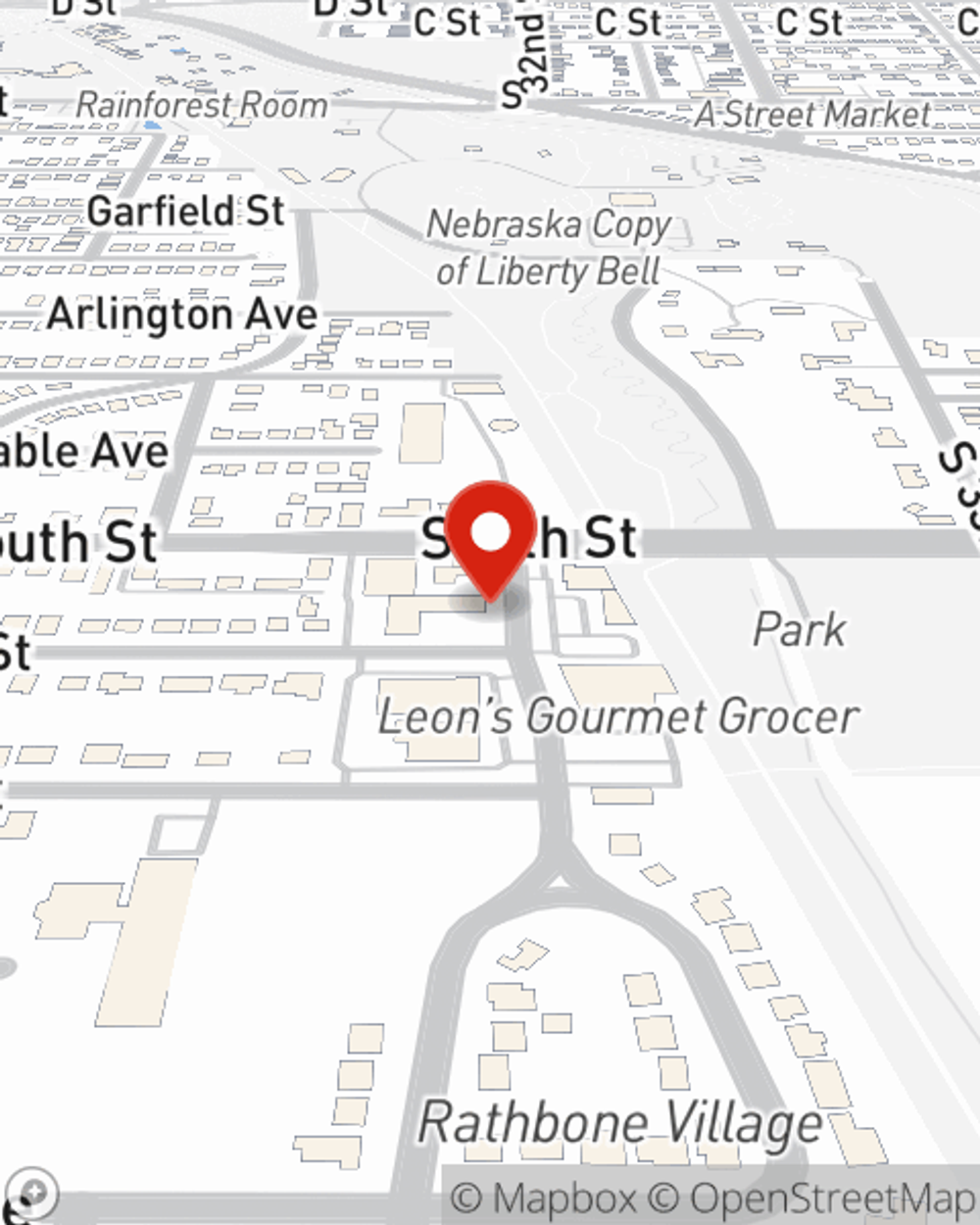

- Lincoln

- Omaha

- Nebraska

- Hickman

- Iowa

- South Dakota

- Kansas

- Gretna

- Norfolk

- Papillion

- Ashland

- La Vista

- Council Bluffs

- Columbus

- York

- Sioux City

- Fremont

- Seward

- Des Moines

- Cedar Rapids

- Bellevue

- Beatrice

- West Des Moines

- Overland Park

Insure The Business You've Built.

Sometimes the unanticipated does occur. It's always better to be prepared for the unfortunate catastrophe, like an employee getting hurt on your business's property.

Get your Lincoln business covered, right here!

Helping insure small businesses since 1935

Strictly Business With State Farm

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like business continuity plans or a surety or fidelity bond, that can be designed to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Kyson Denker can also help you file your claim.

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Kyson Denker today to ask about your business insurance options!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Kyson Denker

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.